In this presentation, we will discuss the deduction related to the business use of a home, specifically a home office for a small business or a sole proprietor. Let's first examine the rationale behind having a write-off or deduction for the business use of a home. If we had a separate office space, we would incur rent or depreciation expenses, which would be considered normal business expenses and eligible for write-off. However, if we work from home and use a part of our home for business purposes, we essentially "rent" that portion of our home for business use. Therefore, there is an allowance for a write-off or deduction for that portion of the home used for business. Now, the issue arises when we mix personal and business expenses. Our goal is to separate them so that we can claim business deductions on the Schedule C, while personal deductions are accounted for elsewhere. For example, we can still deduct the mortgage and property taxes related to the entire home, but we need to allocate a portion of those expenses to the business use of the home. To do this, we have to define the business part of the home and properly allocate the expenses related to it for accurate deduction. For more information and accounting courses, please visit our website at accountinginstruction.info. When it comes to the business use of the home, there are certain requirements to meet for the deductions to be valid. The use must be exclusive, meaning a specific area of the home is solely used for business purposes. Regular use of this designated area is also necessary. Furthermore, the business use must be directly related to the taxpayer's trade or business. These requirements are similar to those for ordinary and necessary business expenses. In conclusion, when considering the deduction for...

Award-winning PDF software

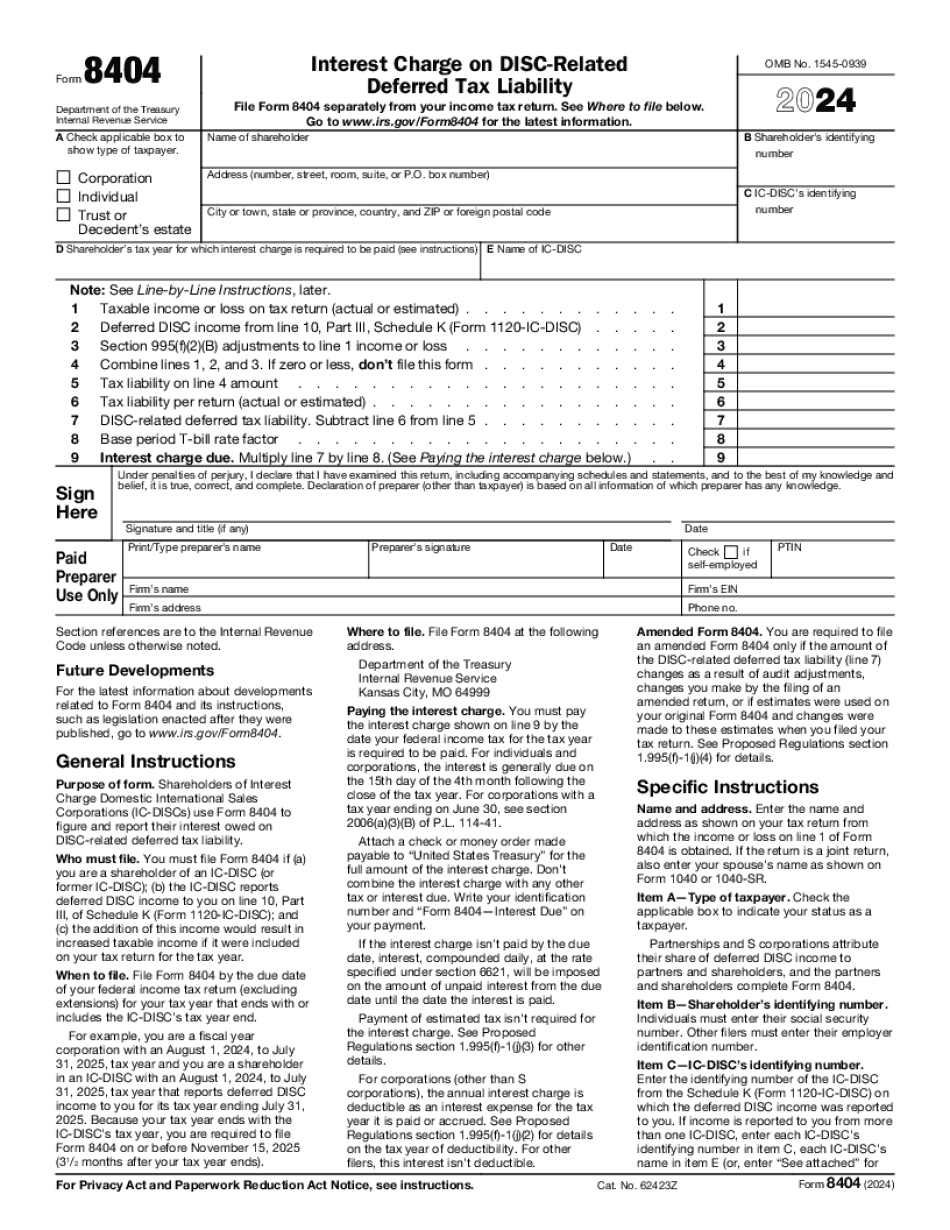

8404 instructions 2025 Form: What You Should Know

Form 8404 — With or Without Interest. Suspended Income and Tax Liability— Roth IRA. The interest charge is computed by the IRS using the current yield on Treasury securities (T-Bill) held by the investor. 2021 Form IRS 8404 Fill Online, Printable, Fillable, Blank Complete the tax calculator 2 form for free The interest charge is computed by the IRS using the current yield on Treasury securities (T-Bill) held by the investor. IRS Tax Table (2017) As of January 1, 2018, the effective tax rate for a taxable distribution of ordinary income or capital gain is zero percent (0%) so you do not need to report interest expense or investment gains for 2017. IRS Form 8404 — Interest Due Form 8404 for interest due is used for individuals to report interest paid or accrued under a deferral arrangement, including: Payments made for interest which is prepaid over a period from years to years. Interest is generally considered to be due if the investor, as a result of the distribution, has a greater than 50% ownership interest of the account or if there are more than 1,000 in payments per calendar year and these payments are made before the first tax day of the year (assuming no changes made by the investor) The current interest rate is based on a three-month interest accrual which is adjusted periodically. Interest is usually accrued if the investor: (1) pays the minimum periodic distribution; (2) is subject to a margin call for the account (i.e., is required by law to pay interest to the IRS); or (3) is required by law to make periodic prepayments of accrued interest. For each year, a new monthly interest rate is applied with the following exceptions: if the minimum monthly distribution requirement is met (this requirement must be met regardless of the total amount of interest accruing on the account); and if income is not sufficient to satisfy the minimum monthly distribution requirement. If any portion of the minimum periodic distribution required to satisfy the minimum monthly distribution requirement is not met on or before the due date, interest, compounded daily, is to be paid on the unpaid portion of such distribution within thirty (30) days after the last day of the month in which the payment is due or when the last payment is made if no such distribution is made on the date required.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8404 Instructions 2025