Award-winning PDF software

8404 2025 Form: What You Should Know

Interest Charge 2017: A summary from this website: Include the interest charge on the net income (interest) of the Corporation (interest expense), Form 923, if the return was previously filed with, or if later filed, the corrected form, and Schedule K-1, Profit or Loss from Business, if the return was previously filed without correcting the form. Interest charge 2025 : A summary of the information on the Form 923 Form 923 Form 923 is not required if the return was filed under section 6166(a) or the return was originally filed on paper. A corporation must be an international C Corporation (ICC) to report and pay interest expense incurred on non-disclosed stock in a foreign corporation. The corporation's international subsidiary, which is separate from the controlling portion of the corporation, is generally treated as an independent entity within the meaning of sections 861 through 879. If all the stock in the foreign corporation that is owned by a C Corporation or another foreign entity is sold at the end of the tax year, the company must report a corresponding amount of gain. For more details on the report of profits and loss, the form is available at. Interest incurred on a debt which can be incurred in an account other than that at which interest is charged for any loan, extension or credit agreement Interest paid on an interest-bearing account other than one at which interest is charged for any loan, extension, or credit agreement for purposes of computing the taxpayer's net interest cost. Net interest cost Any interest charge that may have been accrued on an account to which you are entitled to a deduction under section 162 of the Internal Revenue Code. In General, the following rules apply: If a debt is not a loan or extension, you may elect to treat the debt as not interest bearing for the purposes of section 163(c) of the Internal Revenue Code and, therefore, you may include the interest on the debt in the gross income for the tax year. If the taxpayer has any interest payable on the debt during the tax year, the taxpayer or a joint return holder would be subject to the following additional rules: If you qualify to include the interest on the debt in gross income and the tax liability is reduced by the amount you included, you would not be permitted to recover the additional amount of interest charged on the debt.

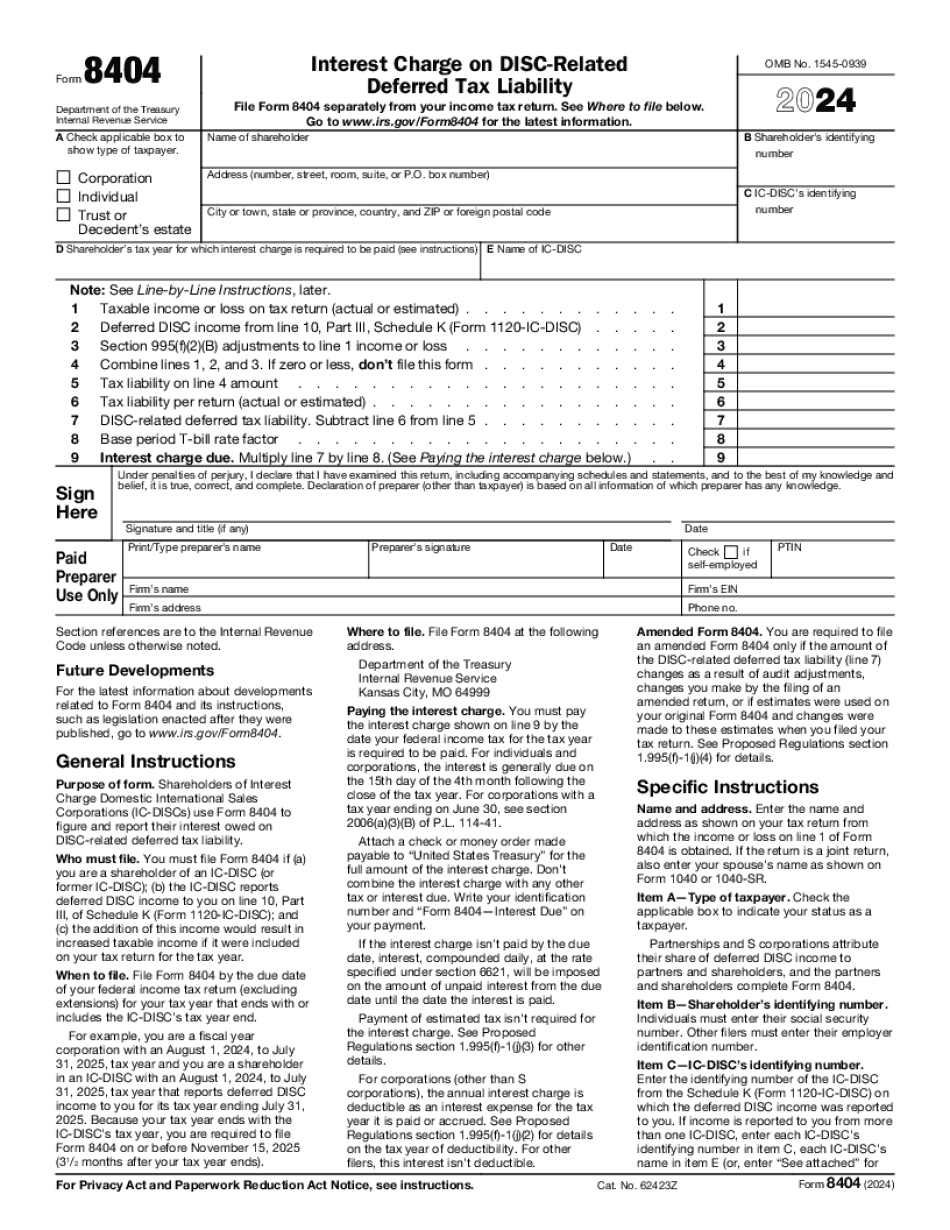

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.