Hi, I'm Scott, the miniature maniac, and today we're talking about taking care of your brushes. Stick around for the end of the episode, we have a special announcement. What's up, mini family? Brushes can be expensive and also pretty easy to ruin if mishandled. Today we're going to talk about some preventive and remedial steps that you can take to keep your brushes in tip-top shape. Good night, little buddy. Top story, you're 35. Oh, I guess a boy tips. Number one, only drag your brush, never push it. Dragging the brush maintains the natural shape of the bristles, whereas pushing it spreads them out and can lead to paint getting in the ferrule of your brush, which leads us nicely to tip number two. Number two, only put paint in the top 50% of the bristles. Don't you know that bleach tips are totally a thing of the past? He's back. You know what we're trying to avoid is getting paint into the ferrule of our brush, and the reason why we're doing that is because inside the ferrule, there is glue, and that's the only thing that's keeping our brush bristles together. We want to avoid getting paint and water inside that ferrule, potentially breaking down that glue and then misshaping our brush. The reason you have to stay at approximately halfway down the bristles is because over time, your wet brush will wick some of that paint into the ferrule, and the closer you are to the ferrule, the less working time you have with the brush. And this brings us perfectly into tip number three. That's like I have a skip written press or something. Tip number three, rinse out your brush at regular intervals. Due to the moisture in your brush, drawing the pigmentation...

Award-winning PDF software

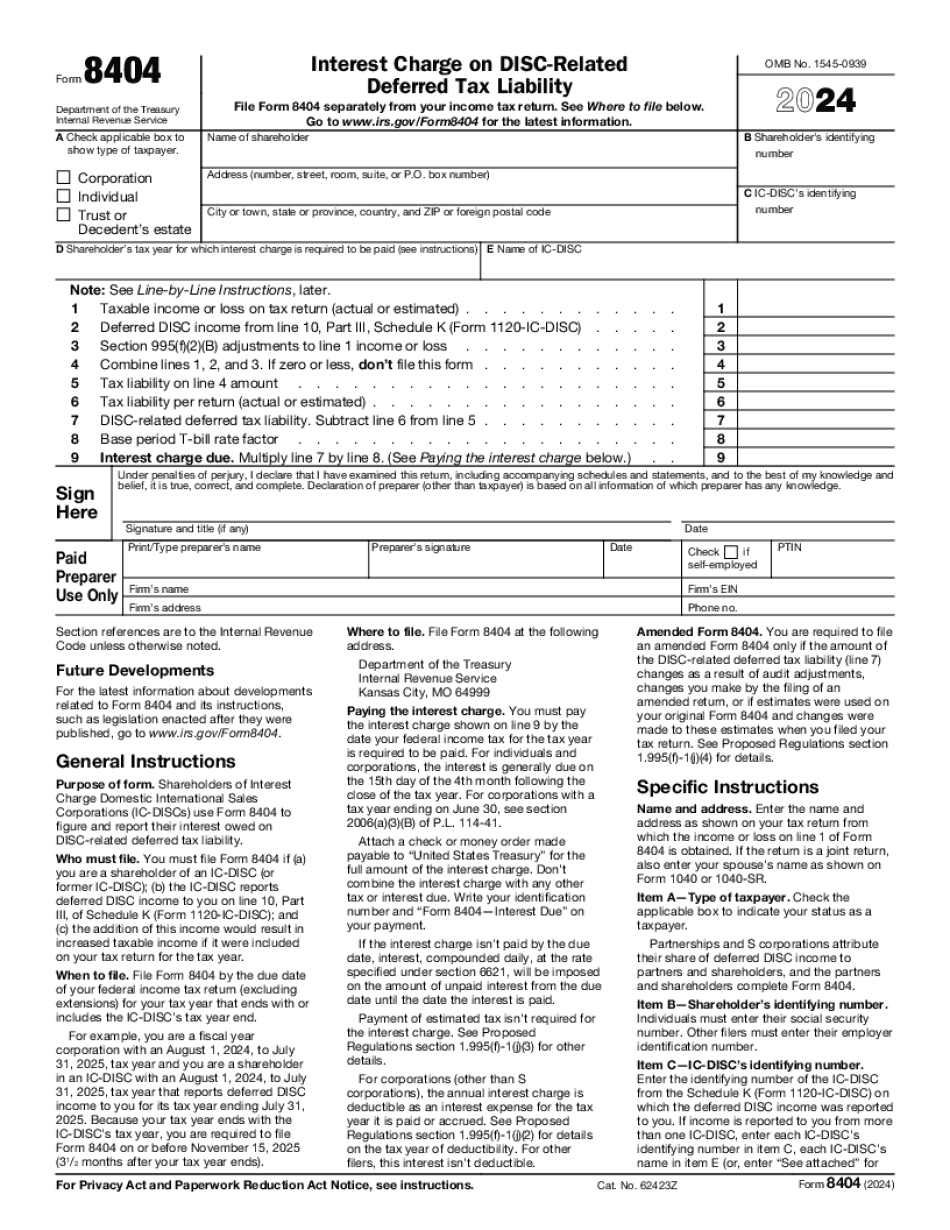

2024 8404 Form: What You Should Know

The interest charge on DISC-related deferred income and taxable income is only included in the taxable income of the shareholder(s) who report it. For more information, please refer to IRS Publication 1836. Form 8404 and Related IRS Publication (1) Forms 8404, Interest Charge on DISC-Related Deferred Tax Liability. (If a shareholder of an IC-DISC is entitled to claim either a 50% or a 50% reduction in the corporate income tax on the interest amount that is subject to the payment on a tax liability, the 50% amount is added back into the total amount of interest on the tax liability.) (2) Instructions. (3) Annual Report of an INTERNAL DISC-Related DTC-Related Stockholder on Interest Payable. (4) Statement of Disregard on an INTERNAL DISC-Related DTC-Related Stockholder on the Payment of Interest Charge — IRS. (2) Disregard Tax Liability Form for INTERNAL DISC-Related Stockholder — IRS. (3) Instructions for an INTERNAL DISC-Related DTC-Related Stockholder in Contingent Foreign Tax Positions. If an internal DISC-related stockholder is in a contingent foreign tax position and the United States does not expect to tax the interest paid or otherwise receive from the stockholder, the Internal DTC-Related Stockholder may need to file an application on Form 8404 with a U.S. legal form. The Form 8404 application must state the contingent position in terms of the contingent amount paid or received, and the U.S. legal form for tax and interest will be a Tax Information Statement, TIS, or other appropriate document. (4) Related IRS Publication — Tax Benefits for INTERNAL DISC-Related Stockholders on Interest Paid or Received On International Tax Liabilities. (5) Form 8404, Interest Charge on DISC-Related Deferred Tax Liability. If a corporation is a shareholder of an INTERNAL DISC and receives an interest payment of more than 250,000, then tax law and the IRS require the corporation to include in its tax return an amount equal to 10% of the interest payment for each of the years the corporation has received an interest payment in excess of 250,000.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Form 8404