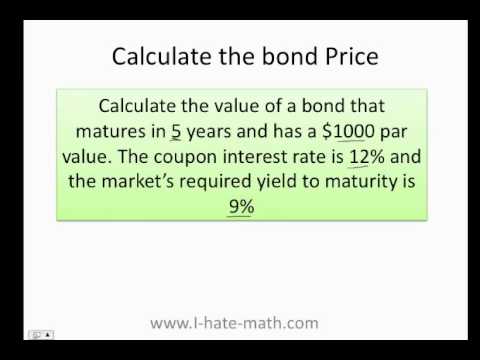

Hi guys, in this video, we're going to learn how to calculate the price of a bond. First of all, let's understand what a bond is. When corporations need money, they sell bonds to investors, who become bond holders. A bond is essentially a loan that the investors give to the company. If you are that investor, the company will repay you in fixed payments. In this case, the company is selling bonds and will give you back the money in fixed payments. Now, let's learn how to calculate them. Let's consider a specific problem. We need to calculate the value of a bond that matures in 13 years with a face value of $1,000. The coupon interest rate is 8% and the market required yield to maturity is 12%. So, let's break down the problem. You have a bond that will be repaid in 13 years. You will receive annual payments equal to 8% of the face value, which is $80. However, currently, the market is paying a yield of 12%, meaning the present value of the bond will be less than $1,000. To determine the present value, we need to figure out the number of terms. In this case, it's 13 years. Since the market rate is 12%, while the company is paying 8%, the present value will be lower than the face value. So, the present value of the bond will be less than $1,000 because the market rate is greater than the coupon interest rate. This situation is disadvantageous for you as it means the market is paying more compared to your agreement with the company. Now, let's proceed with the calculations.

Award-winning PDF software

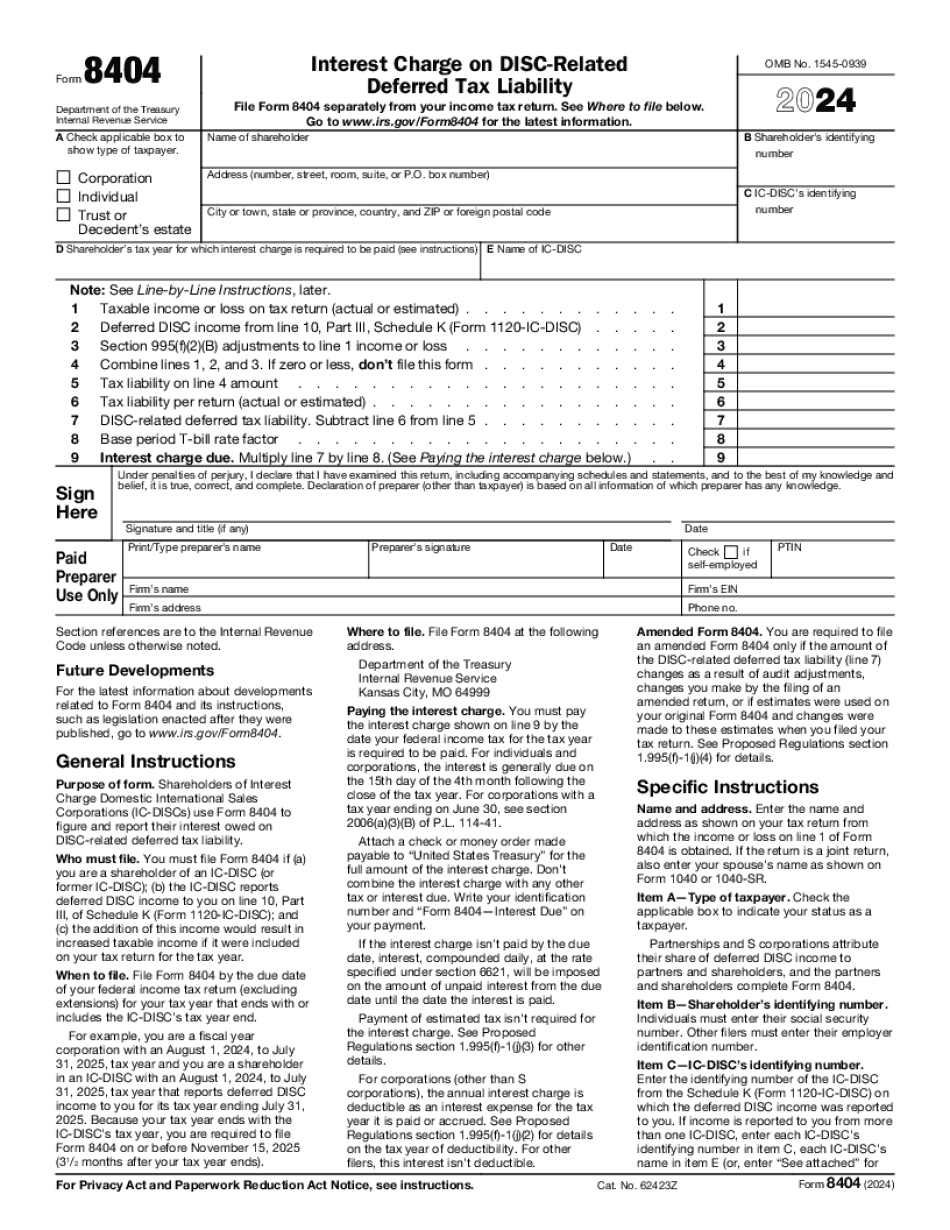

Base period t-bill rate factor 2025 Form: What You Should Know

Act and includes the Maryland-National Sales Tax (MST) as part of its gross receipts tax (GST). 2022–1 February 5, 2022, HIGHLIGHTS — IRS Jan 30, 2025 — The base period T-bill rate factor for 2025 is 0.004392471 for a 365-day tax year. Bulletin No. 2022–46 February 19, 2022, HIS:— IRS Feb 19, 2025 — The following table provides factors for compounding the 2025 base period Bill rate daily for any number of days in the shareholder's taxable year. In general, the base period T-bill rate factor for 2025 is 0.00043481683 for a 365-day tax year. Bulletin No. 2022–45 November 29, 2022, HIGHLIGHTS — IRS Nov 29, 2025 — The table below provides factors for compounding the 2025 base period Bill rate daily for one or more days in the shareholder's taxable year. In general, the base period T-bill rate factor for 2025 is 0.0206298566 for a 365-day tax year. 2023–1 April 7, 2023, HIGHLIGHTS— IRS Apr 7, 2025 — The following table provides factors for compounding the 2025 base period Bill rate daily for any number of days in the shareholder's taxable year. In general, the base period T-bill rate factor for 2025 is 0.0236238063 for a 365-day tax year. 2024–1 October 13, 2024, HIGHLIGHTS — IRS Oct 13, 2025 — The following table provides factors for compounding the 2025 base period Bill rate daily for any number of days in the shareholder's taxable year. In general, the base period T-bill rate factor for 2025 is 0.0231817058 for a 365-day tax year. 2025–1 March 2, 2025, HIGHLIGHTS — IRS Oct 12, 2025 — The following table provides factors for compounding the 2025 base period Bill rate daily for any number of days in the shareholder's taxable year. In general, the base period T-bill rate factor for 2025 is 0.00251609549 for a 365-day tax year, or 0.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Base period t-bill rate factor 2025