1. Music, this is the pinky of Texas entrepreneurs playbook. 2. I'm Jen Lemansky and I'm back again with Frank Lantern, one of our international tax directors. 3. Welcome back to the play, Frank. 4. It's great to be back. 5. So, I know you talked a lot about IC-DISC. 6. How is that impacted by tax reform? 7. Can you give us a little overview of IC-DISC again? 8. That's a great question, kind of backing up. 9. What I see is, it's a vehicle to prtax incentives for exports. 10. It's rather dated as it was originated in the 1970s. 11. It allowed, but more recently was used because of the difference between capital gains tax rates and dividends tax rates. 12. Now that dividends tax rates are the same as capital gains rates, it was used to do raid arbitrage. 13. And assume, so it would the way it basically was. 14. You had to actually set up an IC-DISC entity, let that entity be the exporting entity. 15. There are different variations, whether a commission disc or buy/sell disc. 16. Most people were using the Commission disc. 17. The reason was that you didn't have to change your operating procedures around exports and pra nice tax benefit. 18. Fortunately, the tax reform did not change or repeal the IC-DISC. 19. Oh good, I see this, so that actually is still the law? 20. Great, great. 21. And so, are there any considerations from tax reform that do impact it because it changed any rates or what does that look like? 22. That's oh, that's an equally great question. 23. The answer is, in the benefit with the IC-DISC was really in the raid arbitrage. 24. Okay, so now with the changing rates, so if you were...

Award-winning PDF software

Ic disc 2025 Form: What You Should Know

S. And foreign income. The form includes information about the foreign subsidiary. It includes the foreign income earned by the foreign subsidiary. A special interest levy is required for a foreign subsidiary to engage in U.S. business. An international dividend deferral method may also be applied. The foreign subsidiary may receive interest income and dividend income and may pay dividends in a foreign country as provided in the relevant tax treaty. See page 12. The IRS form 706 is used for certain U. S. source income. The form 609 is used for certain foreign income. Form 6029-S is used for certain domestic interest income. Form 608 is used for certain foreign income. Form 61 is used as an alternative method to report a taxpayer's foreign taxable income for U.S. tax purposes. Form 8603 is used for certain foreign tax-exempt or income-tax-exempt business income. Form 8074 will be given to the taxpayer to verify foreign source income earned from a foreign corporation or partnership, if any foreign affiliate entity is required to file Form 8807. Form 8808 is used for certain foreign tax-exempt or income-tax-exempt business income. Form 8809 is used for certain foreign tax-exempt or income-tax-exempt business income. Form 8012 is used for specific foreign tax purposes. Forms 706, 709, 496(a), and 986 are used for international income. Form 607 is used for specific foreign tax purposes. Forms 1040-ES and 1040-ESA are used for foreign tax-exempt or income-tax-exempt business income. Schedule C may appear on Form 607. Schedule C-EZ does not appear on 607. Form 8074 will be given to the taxpayer to verify foreign source income earned from a foreign corporation or partnership, if any foreign affiliate entity is required to file Form 8807. Foreign corporations that have not been certified under the IRR are not required to file Form 8807. Form 8608 and Form 8608-EZ may appear on Form 8607. If you are filing a Form 607 for foreign income tax purposes, you may get a Form 8606-EZ.

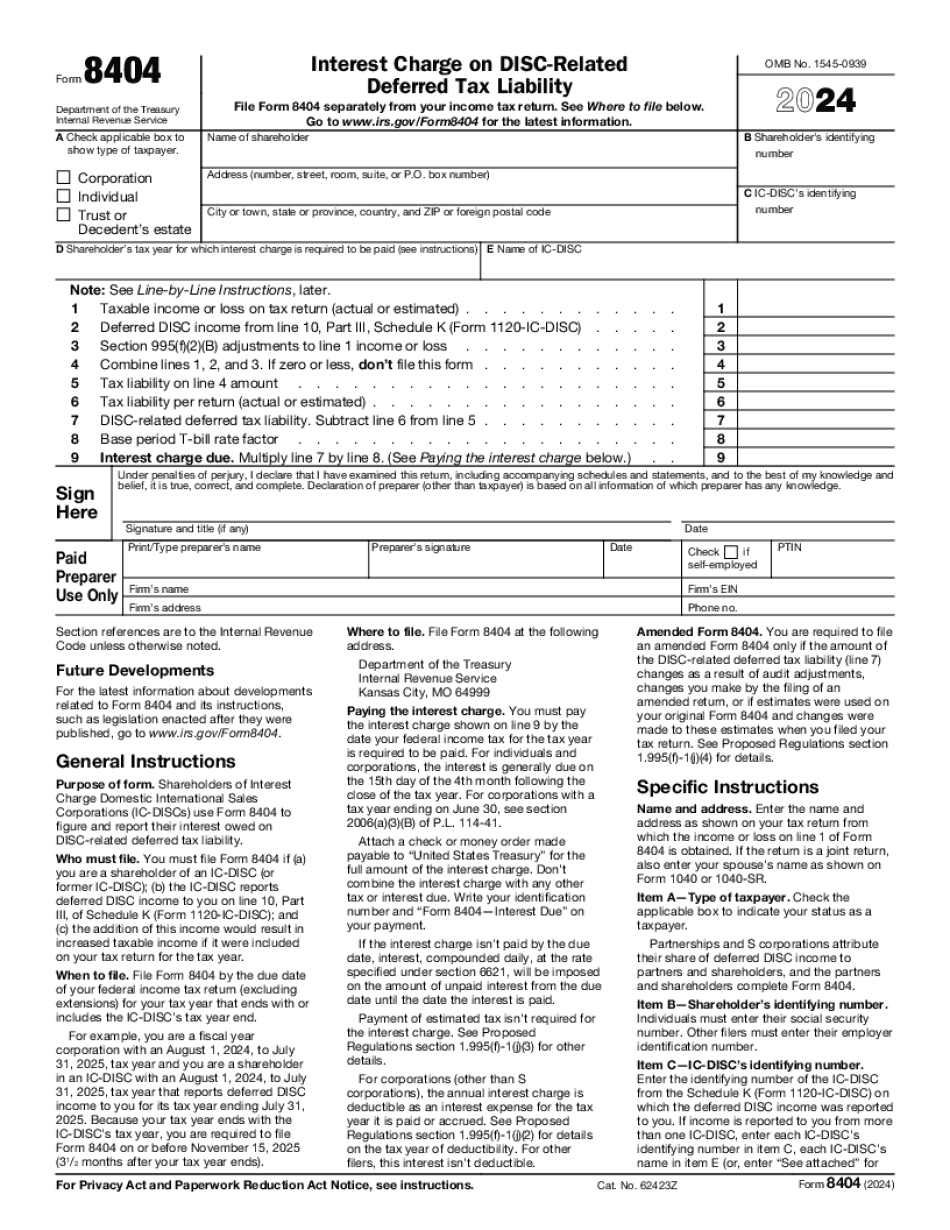

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ic disc 2025