Award-winning PDF software

Ic-disc tax re Form: What You Should Know

IC-DISC: What is it, How does it work? — BMC Dec 30, 2025 — This document explains how the domestic sales corporation (Disc) or the international sales corporation (IC-DISC) was created, to help you decide if an international sales corporation (DISC) might be a good option for you IC-DISC: Who needs an IC-DISC, and when, and the tax rates— IRS Aug 12, 2025 — This form is to determine the tax treatment of a business with domestic sales profits that include interest charge domestic sales corporations (Discs) and foreign sales corporations (Discs). IC-DISC: What is it, How does it work? — BMC July 11, 2025 — This form is to determine tax treatment of business income received from an interest charge domestic international sales corporation (Disc) or foreign international sales corporation (IC-DISC). The Importance of IRS Form 8886 and Income Taxation of International Businesses — IR-2018-36G Jul 15, 2025 — The IRS needs to know where you make international sales and the income you report on the form. To track income overseas, and to protect the U.S. from tax abuse by foreign tax evaders, the IRS is issuing new information about its information regarding foreign sales and foreign source income tax. IR-2018-36G, Foreign Sales and Taxation of U.S. Enterprises for Domestic Business — IRS Mar 23, 2025 — The foreign sales tax (FST) is a tax imposed on sales of property and services to foreign customers. It is imposed at an rate specified in the Internal Revenue Code, and imposed only if an item is sold into a foreign market. FST may not apply to business activities in the U.S. that are primarily incidental to the normal conduct of the business. This guidance explains when each rate applies to an activity. See also Publication 523, Tax Guide for Small Business, for more information on FST. How the Foreign Sales Tax Gap Works — IRS Jun 21, 2025 — When a corporation has more than a certain amount of foreign base company income, the corporation is allowed a foreign source tax credit (FTC), in certain circumstances.

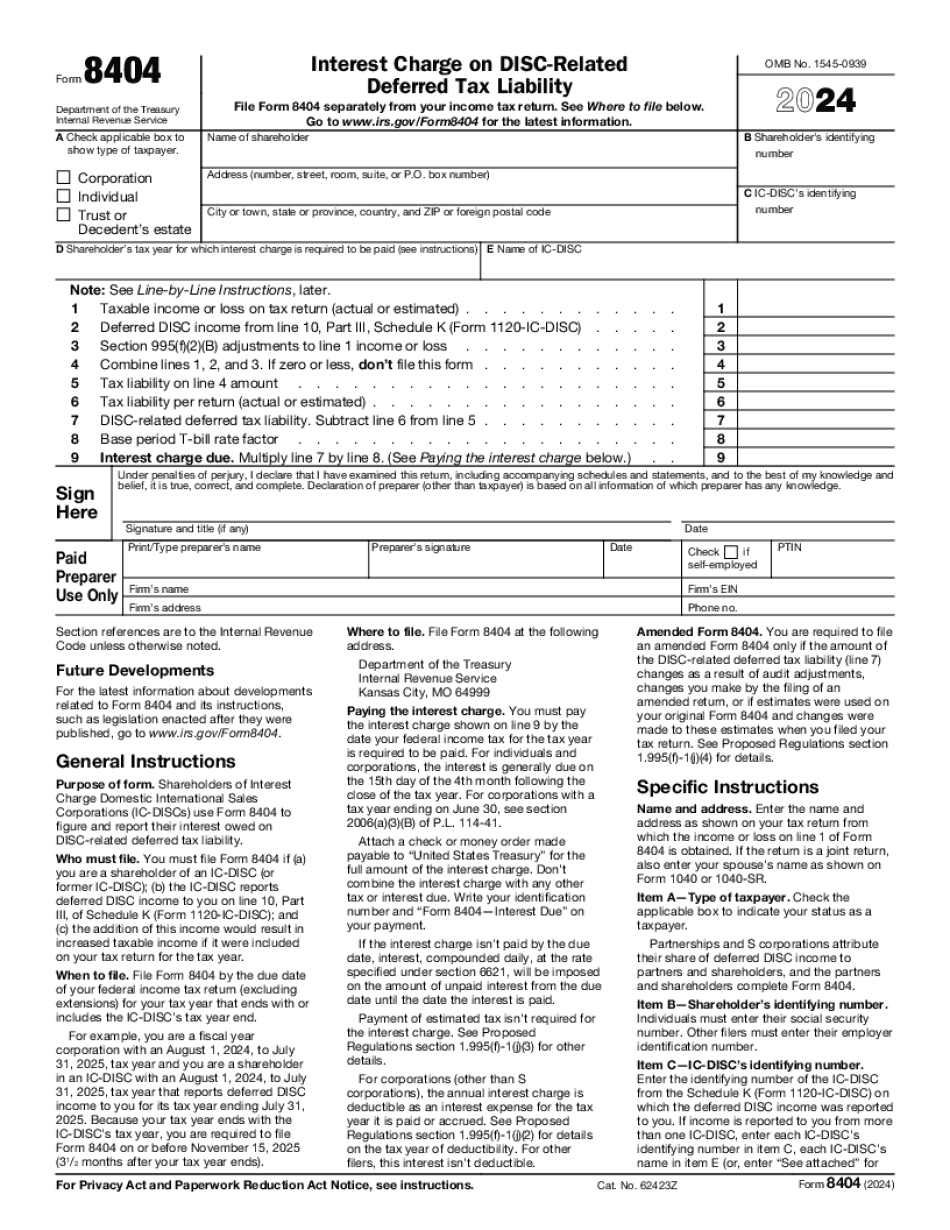

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.