Let's get your chaps on. Get ready. They get me boat loaded. See, I'm being on this side, yeah, you see Spurs, yeah, you see how they're turned in as it turned in. So you don't, you can really get in and get a hold of that bull right without getting your foot in a bind. That's why these Spurs are angled in, it's there so you can help you hang on. So what if he jumps around in the shoe? If he jumps around in the shoot, you got to get your knees up, get them up, up, up on his back and keep your feet straight. Because if you get up in the shoe, if he's jumping in that chute, you don't want him banging your knees. Yes sir, you get your feet up, get your knees up over his back and then you're going straight with it. Any ain't gonna throw you over the front of him 'cause your knees are up in front of you, okay? Warm your Rope up before you put your vest on. You don't get hot, you're putting this on, there it makes it sticky, so to stick to your glove when you pull your rope tight. This does, yeah, that way it helps you, it helps you hang. Keep our rope in your hand so it don't jerk out as easy. I'll get it on your handle too, dear. Okay, you won't get your vest on and your boots with the spiders on. I put these around here and you pull them down tight. That keeps your boot from pulling off your foot where you're digging into that bull and hem jerk it, trying to pull your legs up and don't pull your boots off. You're putting this vest on and...

Award-winning PDF software

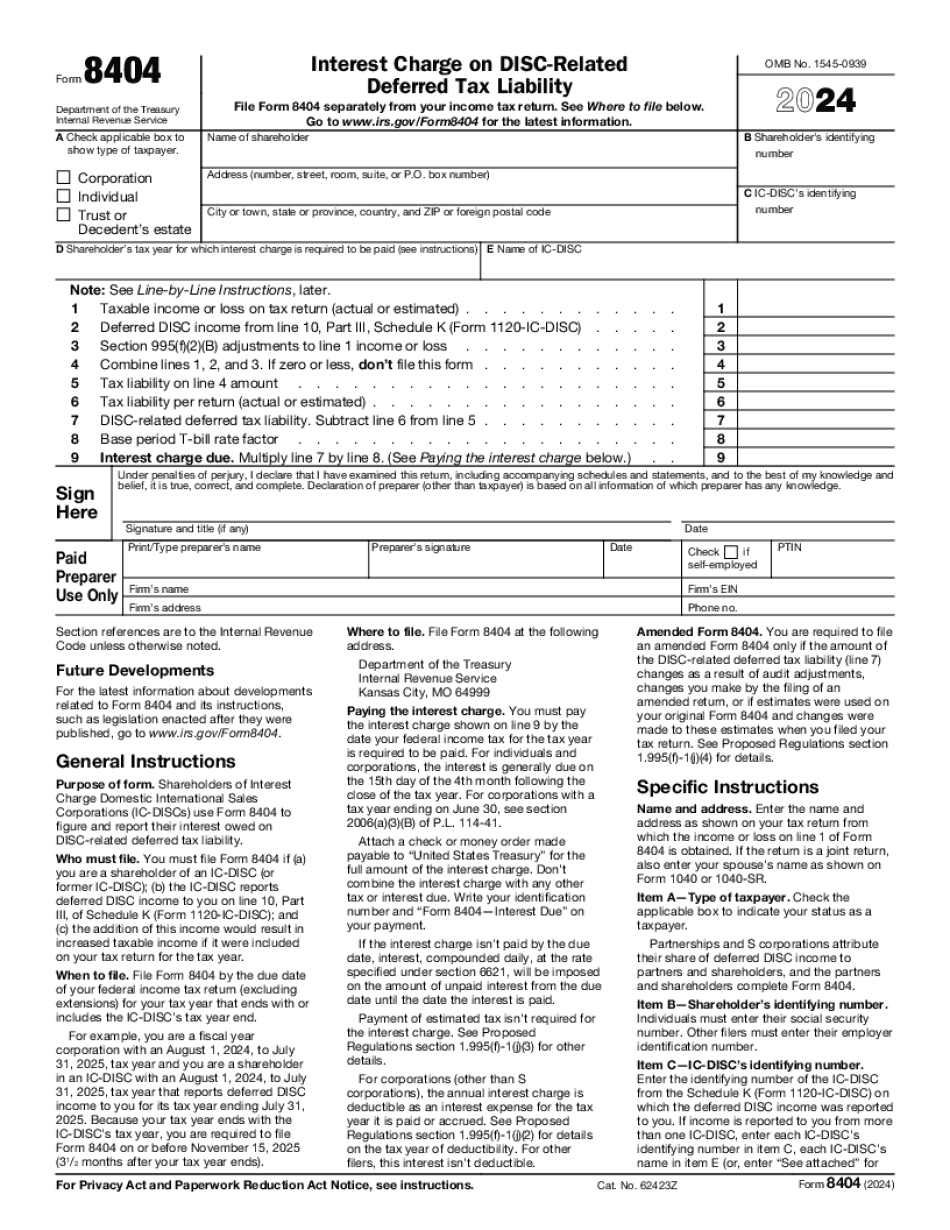

8404 instructions Form: What You Should Know

The Form 8404 is used only when an individual owns or is involved with an exchange in which the shareholder's deferred distribution will be recognized after receipt in participating currency of the entire distribution. The dividend received from the entity is treated as income from sources within the participating country. The interest charge amount on the Form 8404 is computed as follows: Interest Charge on Shareholder's DISC-Related Deferred Income Amount Interest on DISC related amount as described in paragraph 8a(3) of the instructions, plus tax. Amount = Amount + Tax Interest Charge Amount Interest Charge on Dividend Received from IC-DISC — IRS Form 8404 is used only if the shareholder of an IC-DISC holds a voting interest in the IC-DISC and the dividends received by the shareholder are treated as taxes due as of the dividend return date that they are received. Form 8404, Interest Charge on Dividend Received from IC-DISC (1040) Interest Charge on Distributions Not Represented by a Registered Fund — IRS You must file this form if a dividend was treated as dividends in participating currency and interest was paid on the dividend and not recognized in participating currency, and if the amount of dividends received exceeds the amount of interest paid by the dividends treated as dividends in participating currency. This form uses a simple calculation that will assist you to calculate disallowable tax liability and the applicable interest charge. The form 8404 is used only if the dividend was treated as dividends in participating currency and the interest paid is not includible in computing adjusted taxable income and if there are no deductions and payments of interest on dividends to the extent of the dividends treated as dividends in participating currency. Form 8404 Tax Return Correction/Instructions (Form 2341-X) If a taxpayer reports a negative distribution of property from a fund and the distribution is not reported to you on Form 8404, include the Form 8404 interest charge on the property if the distribution is not included in your gross income. If you receive the Form 8404 interest charge, report it on line 12 of your return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8404 Instructions