You testing testing testing - Music testing one two three - Testing testing testing testing okay - Testing one two three testing one two three - Testing testing testing this is the last one - Canary you don't do that well - Good morning good morning everyone - We're gonna go ahead and call this hearing to order - I look forward to hearing the testimony today from the acting commissioner Mr. Cotter - Thanks for joining us and we appreciate your service and willingness to be a part of this subcommittee this morning - To discuss the IRS budget for 2019 - I realize you're testifying before us in this committee for the first time - But this is also a very busy time of year for you, so thanks for your time to be with us - Late last year Congress passed and President Trump signed into law the tax cuts and Jobs Act - As a result of this historic tax reform legislation, American families are taking home more of their hard-earned money - Businesses are expanding, and confidence in our economy is growing, which means more jobs and opportunities for the American people - Mr. Cotter is well aware implementation this law falls primarily on the IRS, the IRS, which is why we provided three hundred and twenty million dollars for its implementation in last month's government funding bill - Specifically, this funding will go toward updating 100 different IRS IT systems to accommodate more than 100 new tax code provisions before the next filing season - This subcommittee is also committed to providing 77 million additional dollars in 2019 to finish the law's implementation - So I look forward to hearing how this implementation is progressing and how we can maintain that momentum as we move ahead through this year - Continuing on to the 2019 budget request as before us, it also includes more...

Award-winning PDF software

Internal revenue bulletin 2025 36 Form: What You Should Know

IRS Pronouncements—2021—Short List Sep 17, 2021, HIGHLIGHTS: General tax provisions—tax rates; new 2025 corporate tax rates—filing requirements; (B) Notice—Taxation for Individuals—Title 26, section 1251, and subchapter Z, chapter 1, section 707; special rule for certain estates Sep 21, 2021—This notice provides a simplified process for individuals seeking a certified copy of their return and provides a brief description of the circumstances in which taxpayers may be eligible for a refund under the tax refund and credit procedures. IRS Pronouncements—2021–Short—List Taxpayer Bulletin: 2023–30—Notice 2023–17; Revenue Ruling 2023–50; Taxpayer Bulletin: 2018–17—Internal Revenue Bulletin 2018-16, 2018–17, and 2018–19; Guidance 2023–10 IRS Pronouncements—2023—Short—List Sep 23, 2021–This notice provides tax relief for U.S. military retired pay— IRS Pronouncements—2023—Short–List Sep 23, 2021, Guidance — Notice 2021–17, page 12 Sep 27, 2021—Notice 2021-61, page 13 provides that the annual rate changes for health insurance coverage and the excise and excise tax will be effective on October 24, 2021. Note the tax provisions set forth in the notice are not effective until after the 2025 tax year, even though the date of the enactment of this change is not on October 25, 2019, at a time when, as explained below, tax rates have already begun to change on October 24, 2019. Notice 2021-61 is not available in its entirety until after the 2025 tax year. The notice includes other information about tax provisions for 2017. IRS Pronouncements—2023–Short–List Sep 27, 2021— Guidance 2150, page 11. IRS Pronouncements—2023—Short–List Sep 27, 2021– Guidance 2150, page 12, footnote 24. Sep 28, 2021—Rev. Pro.

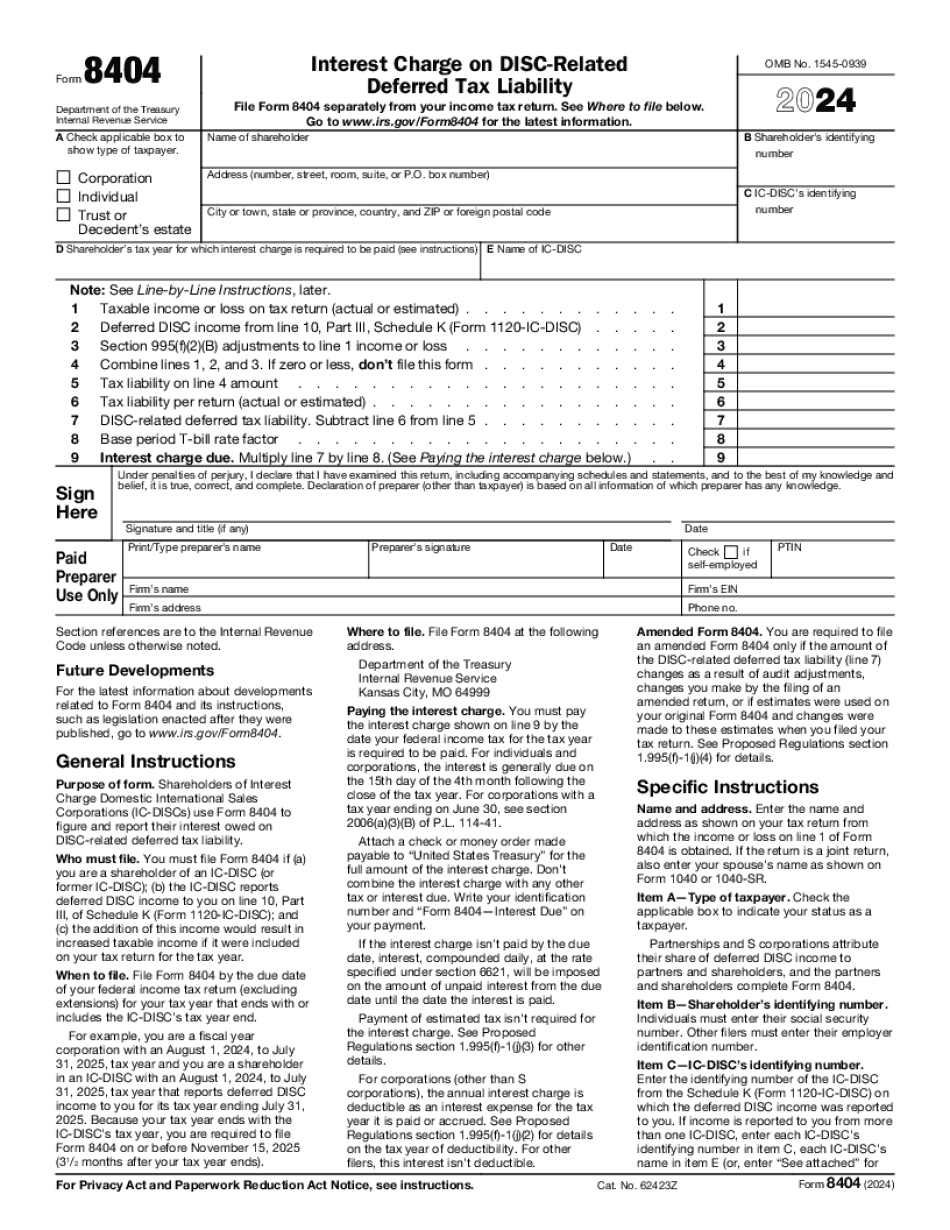

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8404, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8404 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8404 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8404 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Internal revenue bulletin 2025 36