Award-winning PDF software

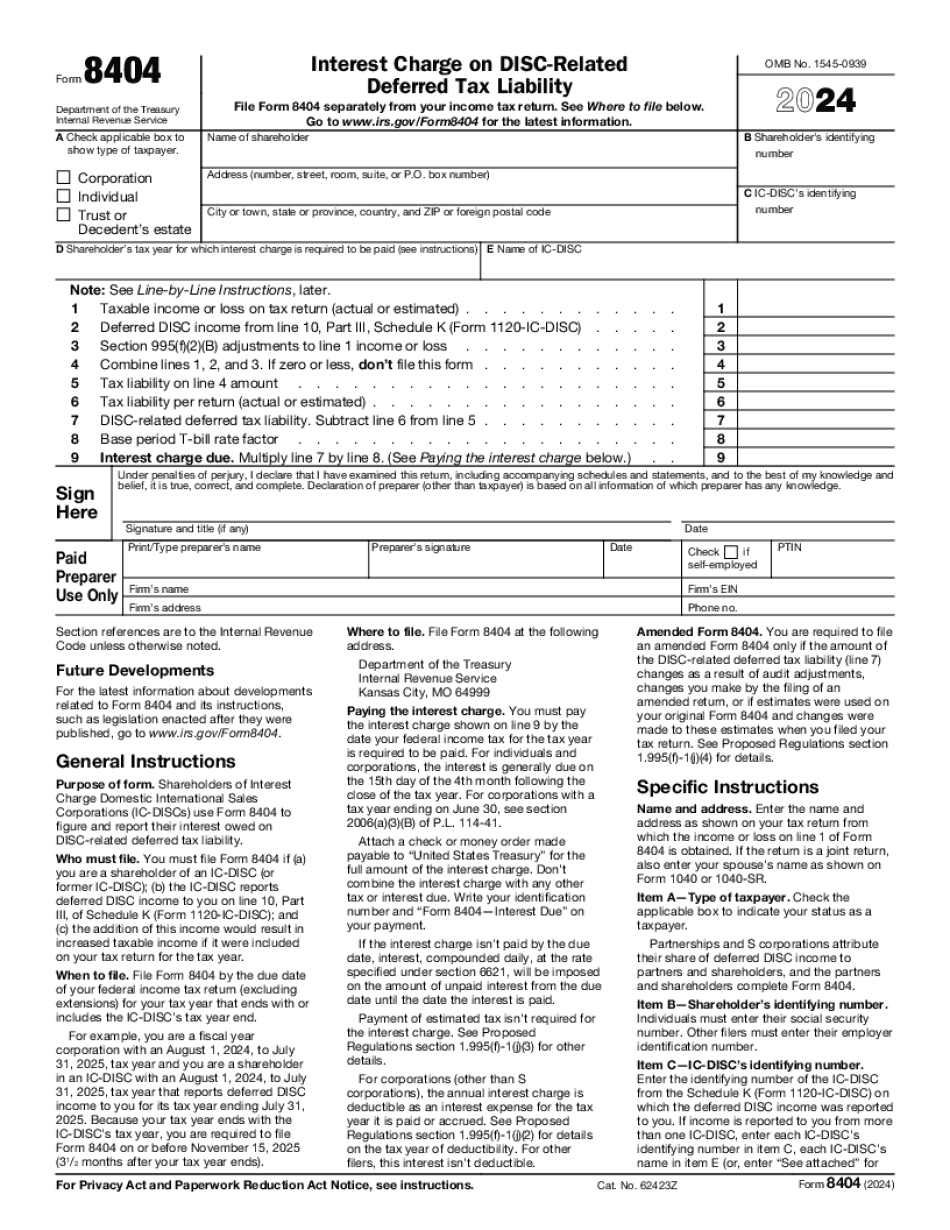

interest charge on disc-related deferred tax liability - internal

The IC-DISC does not have to comply with any other requirement you have to comply with to be a member, except that the IC-DISC must pay for the costs of the IC-DISC's services. (See IC-DISC Fees and Costs section in this Guide for further information.) The IC-DISC requires that your personal computer be operated by a person, at least 18 years old. (See §(e)(1)-(2) and §(e)(2)-(4)) If you plan to do some online use on your personal computer, you must first complete a registration agreement at IC-DISC's Website,, and print out your membership card for your personal computer.

200 - internal revenue service

A) The amount of interest expense associated with our deferred tax liabilities is shown as a component of interest expense in our Consolidated Statements of Operations. The following table summarizes the amount of interest expense incurred in the period ended December 31, 2013, to 2013 related to such deferred tax liabilities. (1) In the interest expense shown above, the amount represented by “Interest expense” is net interest expense on deferred tax assets at the beginning of the period. (2) In the interest expense shown above, the amount represents interest expense on deferred tax assets paid during the month or days in the period for which we receive deferred tax assets. (b) Interest expense on tax benefits will continue to accumulate until all deferred tax asset payments have been made either fully or in full. Interest expense will not be recognized for period ended December 31, 2016, and in future.

Deferred income and tax liability treatment - mcguire sponsel

Determines the amount of investment interest paid on each unit and then divides the total interest value paid by the outstanding debt/equity of the underlying unit(s). In the event dividends are received on common stock, only the dividends on the underlying common stock are included in the calculation of annual interest paid. If capital gains on a sale of a property are included in the calculation of annual interest paid, only the amount of capital gains or income received will be included. IC-DISC does not treat income from the sale of a piece of real estate as an expense of ownership of the underlying property, or as a portion of ownership interest in the underlying unit. As a result of this requirement, IC-DISC has no ability to adjust its interest charge to reflect capital gains and income on the sale of a property. This could be a problem if the.

form 8404 "interest charge on disc-related deferred tax

The form asks you: “Include the following information for each entity and person you own or control”. Please note that this form is NOT a tax form, which is required for citizens and permanent residents, or anyone filing a Schedule C of their tax return. For that reason, please do not include income from your rental real estate activities on this form. The information that we collected at this time consists of the following: Name of real estate investor and owners or individuals StreetAddress and number of units City and state Zip code Owner organization Organization name (if applicable) Address Phone number and e-mail The form is available online. The Taxpayers' Guide to Taxes on Real Estate (TIGER) provides specific instructions for completing the tax form. The form is available at the TIGER Website. If you need immediate assistance during the tax season, call our office at or write us at: Taxpayers' Guide Division City of Rochester Municipal Court 250 Post Street.

Form 8404, interest charge on disc-related deferred tax liability

Doc. No.: 77-87313. Decided: August 11, 2004 Before: REHNQUIST, Chief Judge of the United States Court of Appeals for the District of Columbia Circuit Robert A. Levy, Jr. of the Department of Justice (Assistant Attorney General), for Respondents. Christopher M. B. St. John of the Office of General Counsel, Department of Justice, for Amicus Curiae. James A. F. Plan of the Office of General Counsel, Department of Justice, for Amicus Curiae. David B. Opel, Robert B. Wood field, James T. Holmes, Steven R. Vladek, and Benjamin M. Maker of the Office of Legal Counsel, United States Department of Justice, for Amicus Curiae. Before REHNQUIST, Chief Judge, and SCALIA, J. Appellants, two law firms with offices in Chicago and New York, filed this consolidated interrelated appeal to the United States Court of Appeals for the District of Columbia Circuit against a district court decision denying their motion to dismiss. Respondents, a state, county,.