Award-winning PDF software

Form 8404 Carmel Indiana: What You Should Know

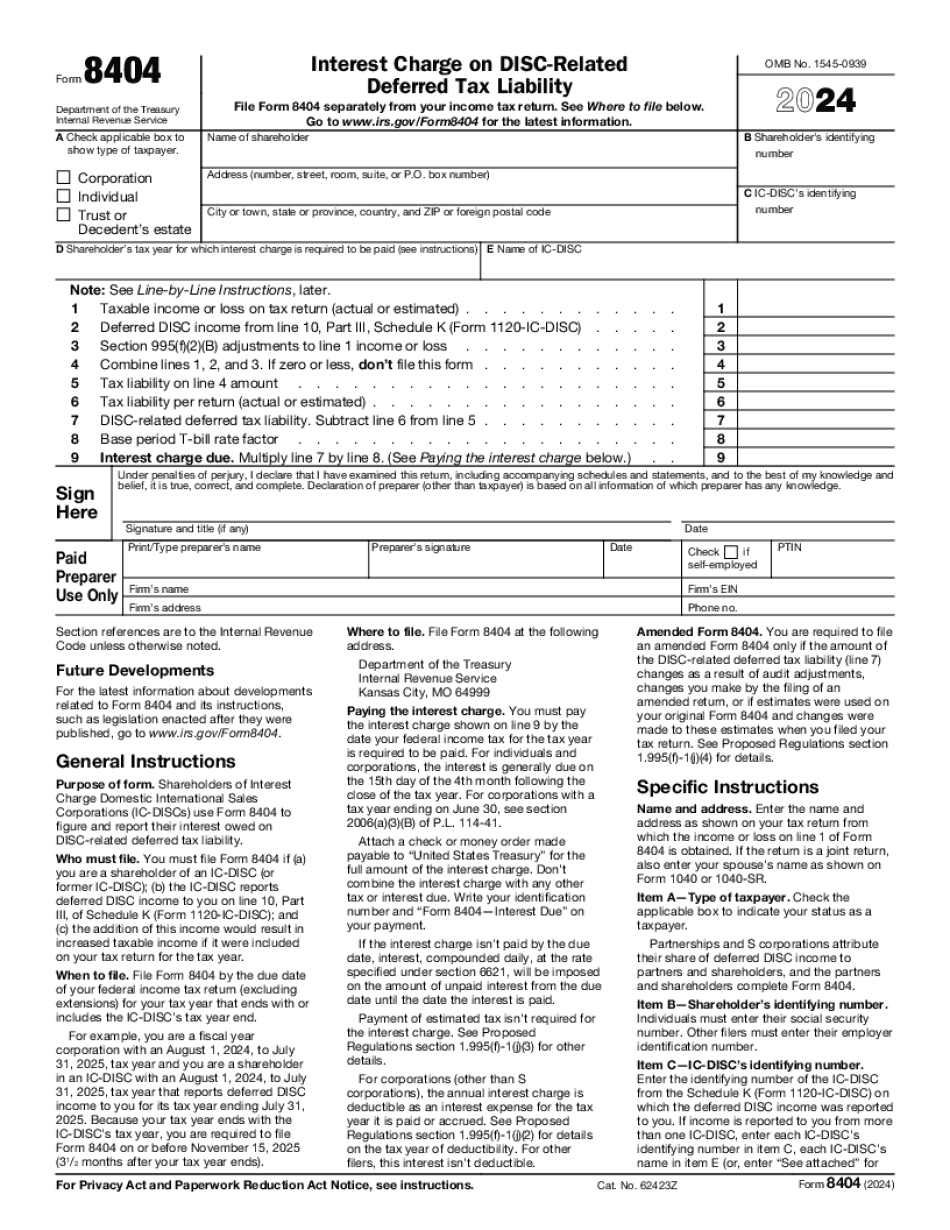

If you are unsure about your county of interest, please consult a lawyer. You do NOT have to complete a Schedule K (the second page of Schedule K) until you are 90 days past the end of the year. You may file Form 8404 by mail, in person, via the internet or over the telephone to any designated IRS or FOR tax payment center. Your form will be sent from the designated IRS or FOR Tax Payment Center to the specified address as shown on the form. Keep copies. Please take care not to send a Form 8404 with only a letter to IRS or FOR tax center. If there is a problem with the form after it is received, follow the instructions on the form. The amount of tax paid using Form 8404 is reported in Box A of box 24 (and on Forms 1040(K), 1040A(K), 1040AQ(K), 1040NR, 1040NRQ, 1040NR2, 1040NRD, 1040NRV, 1040SF, 1040G2, 1040G5, 1040G5D, 1040NRU, 1040RU and 1040SQ). If you are filing jointly with a spouse who has a valid SSN or EIN or a U.S. Government employee pension from an authorized Pension Benefit Guaranty Corporation (PGC) such as VA or CHIP, they may have Form W-2 from the PGC. The amount of pension and retirement income that is reported on W-2 can be a very important factor in determining your tax and penalty payments if you are self-employed or are working for a self-insured employer. The Form W-2 will not have a box to report tax paid from any retirement plan that pays you at least 2 times what is being paid to you. Form 8404 for Certain Property Acquired by a Property Trust Any purchase or sale of real property (also called a “mortgage”) by a trust after December 31, 1997, must be treated as a sale for federal estate tax purposes. The trust may be able to apply this rule to a part of the property it acquired without regard to the date of the trust or the name of the trust, such as a personal residence that was acquired by the trust before it began paying its income tax. If you are involved in a trust transaction, it is important to follow the advice listed above.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8404 Carmel Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8404 Carmel Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8404 Carmel Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8404 Carmel Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.