Award-winning PDF software

Form 8404 for Brownsville Texas: What You Should Know

P.O. Box 629 H.B. MOULTON TX 7800. I have been a business owner for 40 years and I own and operate two companies, each one of them providing transportation. They also provide a wide variety of materials, equipment and merchandise to various commercial, industrial and public service customers. I am also in private practice and have been for 20 years. For the last 17 years, I have conducted most of my business at our offices located in Humble, Texas. I have not paid state sales tax on goods I make to retail customers in Texas. With the creation of the Texas Retailers Tax, beginning in 2025 I started paying the retail sales tax of 23 per item in the amounts of 3, 5, and 7 per taxable item. My clients typically paid the 12 and 16 sales tax. These were bills that were mailed to me. I collected these bills along with their receipts and made sure that I sent a notice to both my client and me. They were then returned to me in the mail along with their receipts along with a “notice of tax compliance” form indicating when and where they received the notice. There were no refunds issued to my clients for these bills. When I received these bills for the first time, I was unaware of the law. The notice that I mailed was as follows: “You have filed a Texas sales/use tax return. You may be eligible for the exemption from paying sales tax in certain cases. Please review the exemptions for your county on the back of this notice for information about your eligibility. You may also call the Texas Department of Revenue Office at to learn more about exemptions. A tax office representative will call you to discuss your status with you.” What's a Texas Retailer? Under the Texas Retailer Use Tax Ordinance, the term 'retailer' includes any taxable person to whom the sales tax is paid.

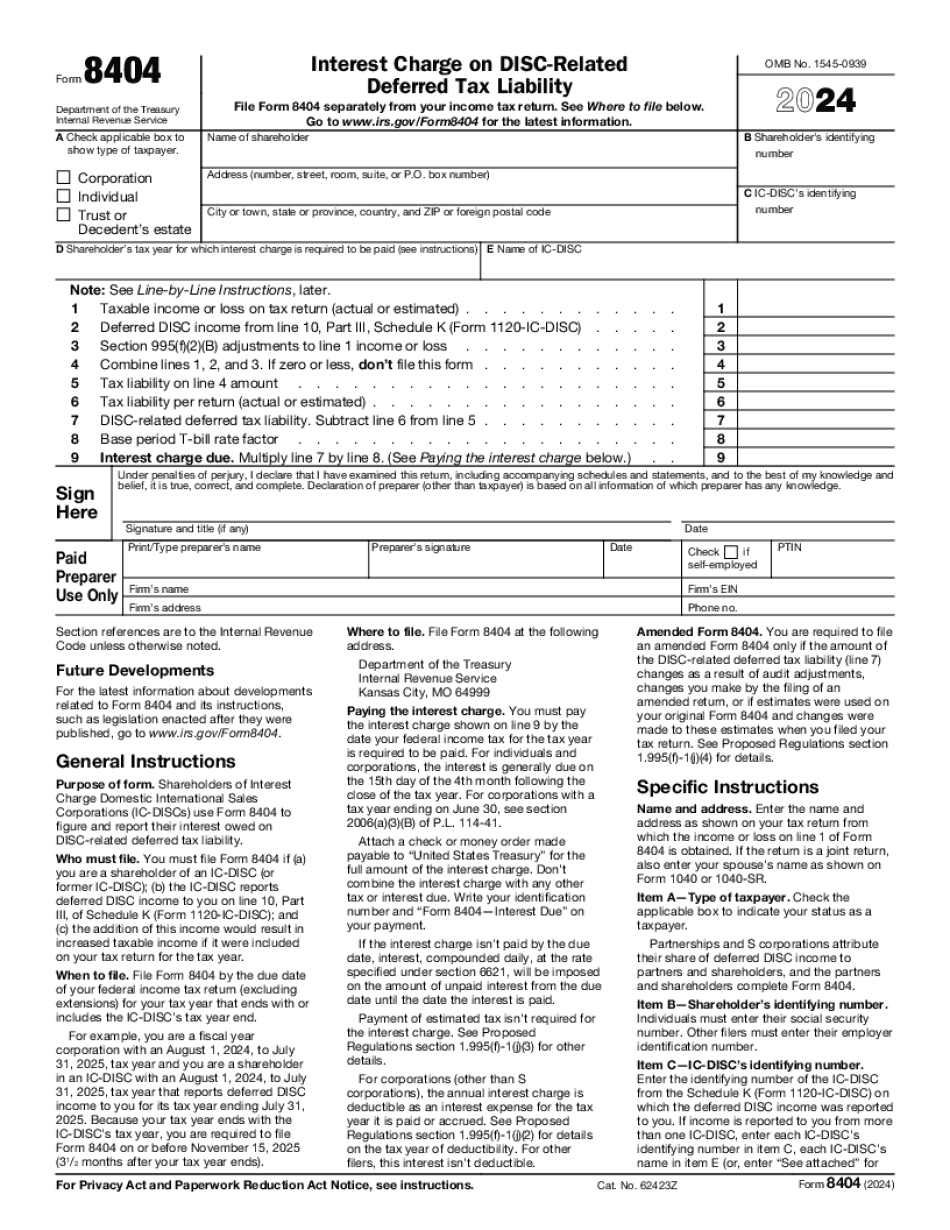

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8404 for Brownsville Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8404 for Brownsville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8404 for Brownsville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8404 for Brownsville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.