Award-winning PDF software

Form 8404 for Hollywood Florida: What You Should Know

PROPRIETARY FUNDS: Statement of Net Position. 36-39. Reconciliation of the Statement of Net Position of Proprietary Funds. Form 8: Fill out & sign online — Chub Reimbursement of Tax in the Amount Required to Be Paid by You as a Returned Individual Taxpayer If you meet the rules for the Special Self-Employment Exemption, a tax-free reimbursement can be offered by the FL Dept. of Revenue in the amount of one of the following: 1) 25% of your Social Security and Medicare taxes in 2025 (if there are no items withheld); or 2) 3,000 of your AGI (for 2015). Please note that some taxpayers may qualify as a FICA employee. If the deduction is less than one week of tax, you cannot claim the deduction in the calendar year. For more information, see the FAQs. Reverse Mortgage Tax Benefits — How to Claim Your MTB Mortgages Qualify for Reverse Mortgage Tax Benefits Reverse Mortgage Tax Benefits — How to Claim MCB Reverse Mortgage Tax Benefits — How to Claim MTB Reverse Mortgage Tax Benefits — How to Claim MTB TOTAL BENEFICIARIES: TOTAL BENEFICIARIES. In order to use the reverse mortgage tax benefits claimable against your 2025 or 2025 tax return you must complete and submit the online Form 982 with your 2025 tax return information. However, the tax benefits claimable by 2025 are subject to the same rules as the 2025 claimable claims. Other Income You Will Get From Reverse Mortgage Tax Benefits Additional Information You Need to Know There are two types of income which are eligible for the reverse mortgage tax benefits. The first one is income that's not used for the principal of the principal home The second one is that which is used for financing the loan. If your RITA is a primary residence (PPR), you don't get the RITA tax benefits on the additional income if it: Is used to finance the principal of the principal residence. Is only used to finance the principal of the PPR home. Does not exceed the 50% limitation. Is not used for a qualified higher education expense. Is not used to satisfy a tax-exempt interest. Is not used to satisfy a deductible educational loan.

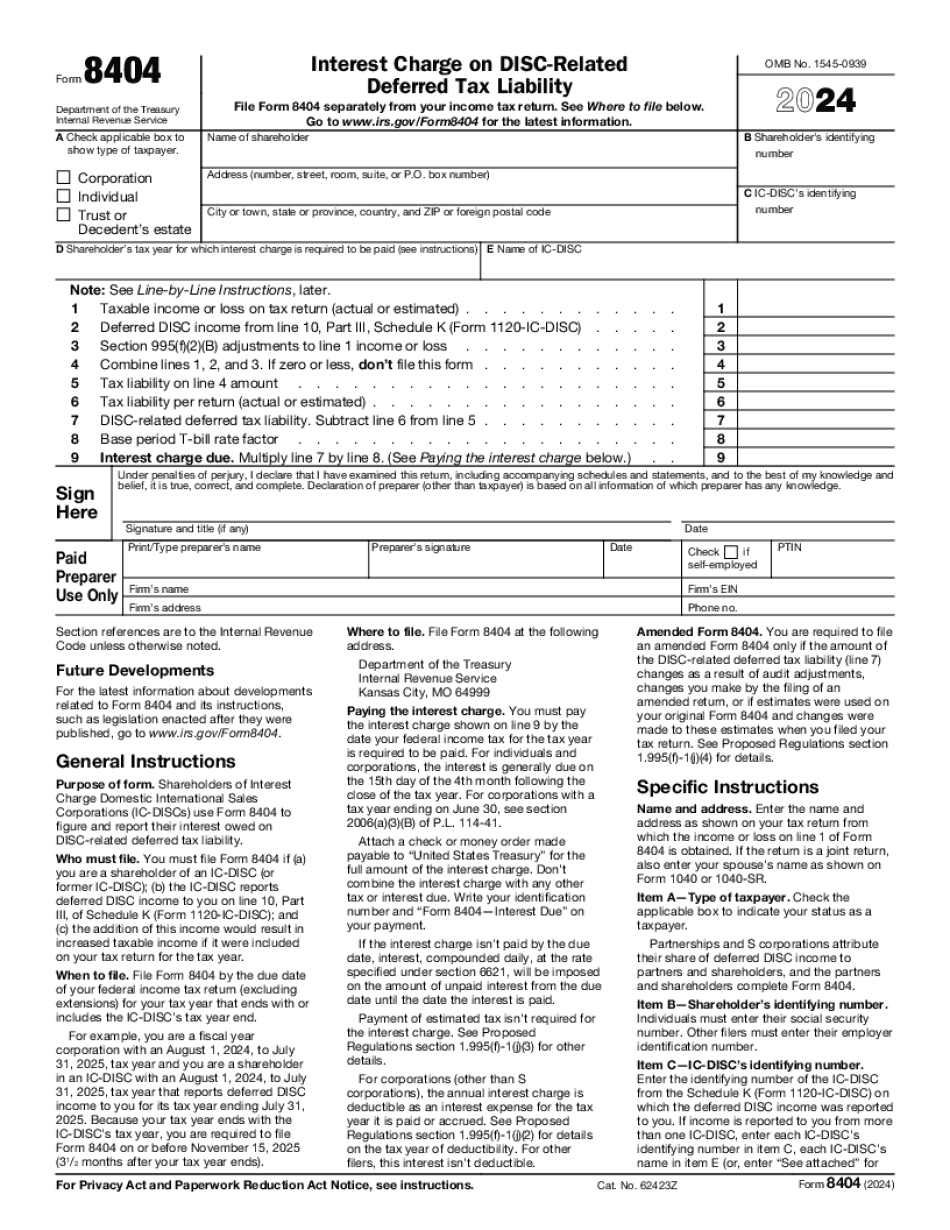

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8404 for Hollywood Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8404 for Hollywood Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8404 for Hollywood Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8404 for Hollywood Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.