Award-winning PDF software

Form 8404 Wilmington North Carolina: What You Should Know

Investors who hold or intend to hold IC-DISC common units and related interests in the Unit and Interest Trusts may establish in their records their ability to pay tax on the Unit Interests (and also the Interest Trusts) without an adverse valuation (as the Trustee or the DEQ determines) for the Unit Interests without incurring capital gains. It is important that there be full and complete documentation of the methodologies used by the shareholder(s) at the start of their investment activities, and after they dispose of their IC-DISC common units. Therefore, if an investor wishes to establish that they will pay tax on the Units, Income Trusts, Interest Trusts and any income that could have been received from the purchase of a unit, an investment, dividend, sale of interests in a Unit Interest, an interest in the Income Trust and any income from investing in an Income Trust, that investor should utilize the Income Trusts' Operating Procedures. North Carolina General Statutes Section 9-9-23 The Income Trust, which is the sole and exclusive method of payment under the Trust, will have no other terms. Section 9-9-22 The income received with respect to an interest in the Unit and Interest Trust shall be paid to the Trustee pursuant to an agreement on behalf of the Trustee that: (1) shall specify the method by which the income will be received by the Trustee and (2) shall contain certain provisions, which such provisions the Trustee shall take any steps reasonably necessary to enforce in any manner provided by law. Section 9-9-23 The Trustee and the Trustee's representatives and employees are allowed unlimited reimbursement from the United States for reasonable and necessary expenses incurred by them in connection therewith. Section 9-9-24 Notwithstanding anything to the contrary contained in Section 9-9-23, the Trustees will receive, on payment of amounts due to them, distributions of income to the extent that such distributions represent income from the sale of Units, Interest Trusts, Units, Interest in Units, or all or any portion of the value of any Units, Interest in Units, Indebtedness, and Indebtedness of the Trust or a Subsidiary. Form D — New Jersey State Department of Treasury 1560 Broad Street, Room 1618. Newark, New Jersey, 07102, Form D — New York Treasury 140 Broad Street, Room 1360.

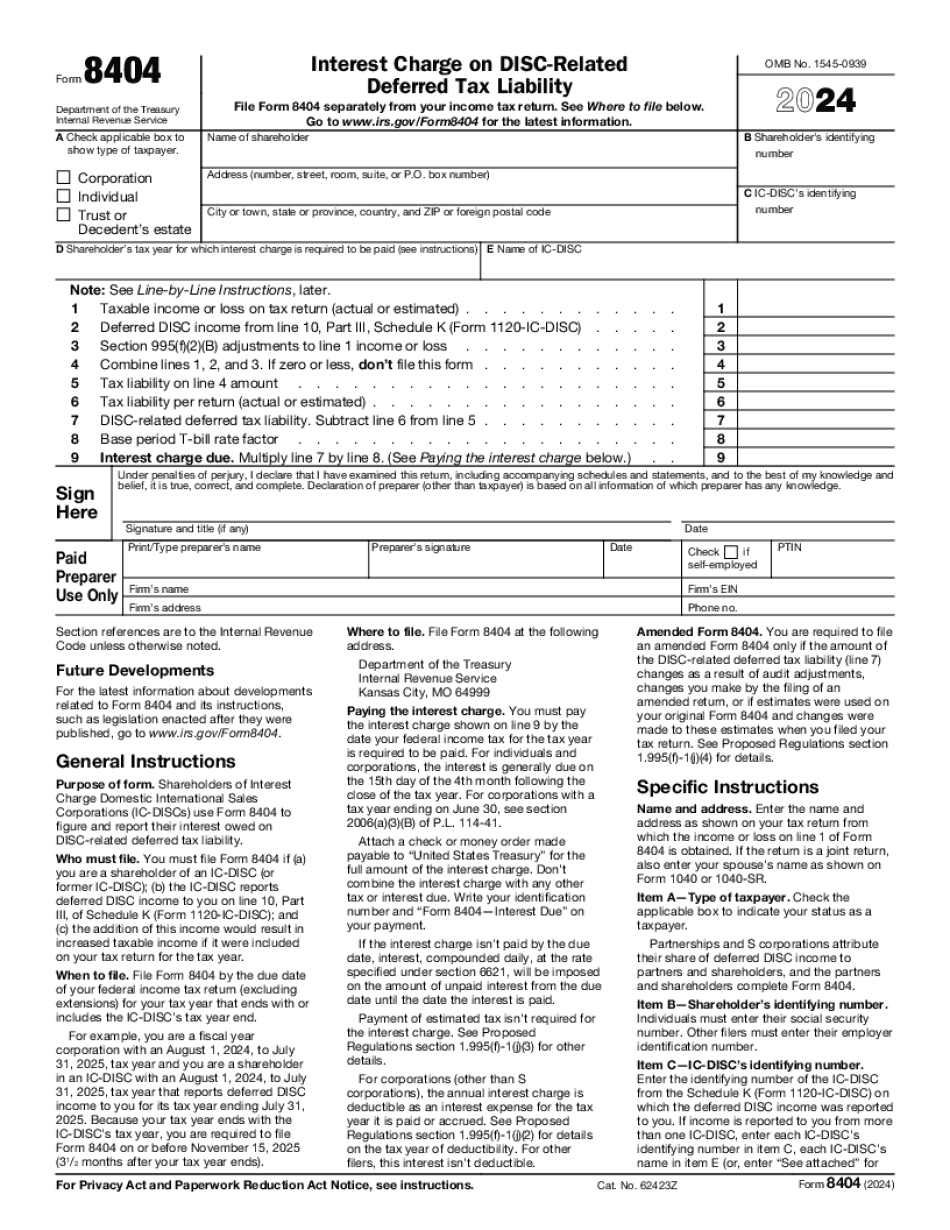

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8404 Wilmington North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8404 Wilmington North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8404 Wilmington North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8404 Wilmington North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.