Award-winning PDF software

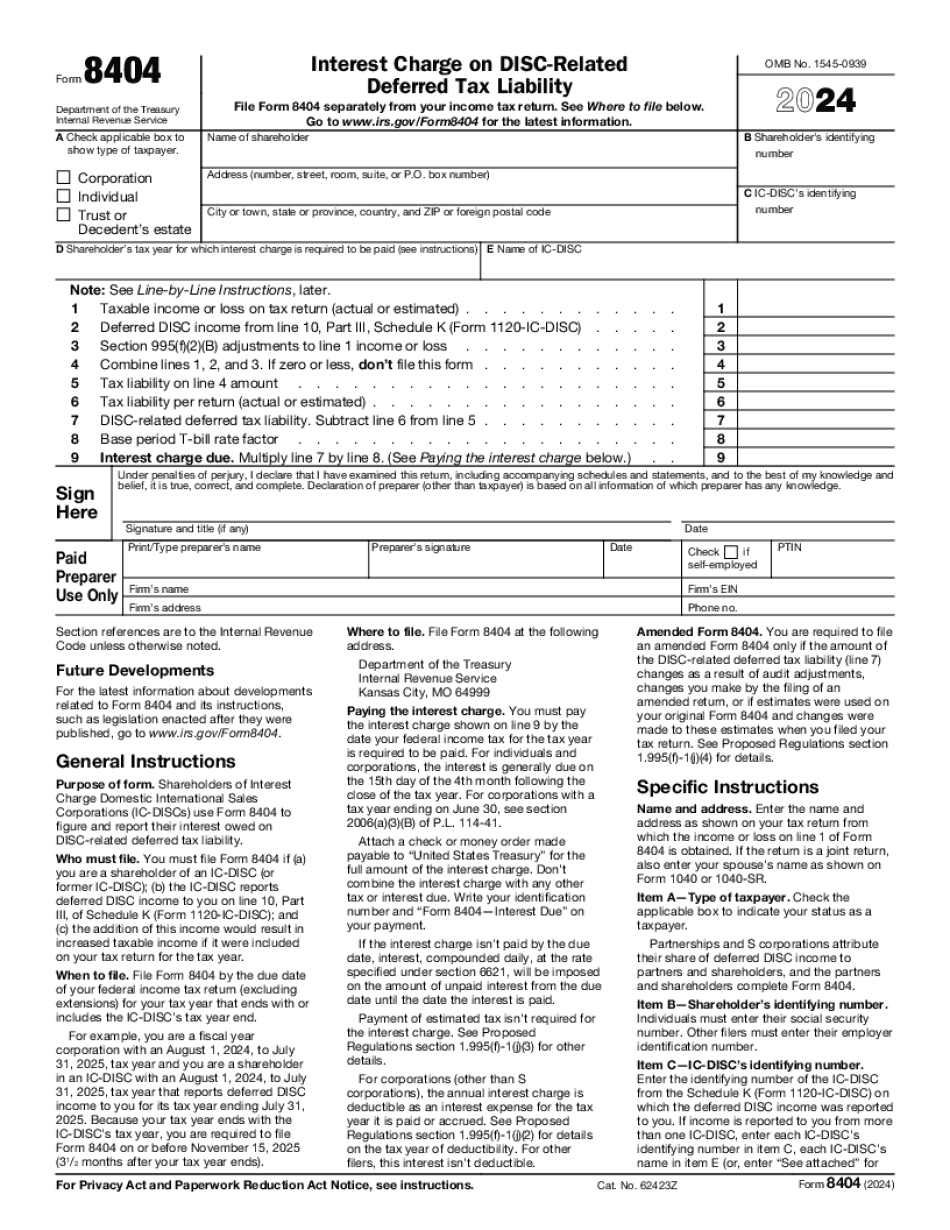

North Las Vegas Nevada Form 8404: What You Should Know

The interest charge is then multiplied by the number of shares held in the trust prior to the change in the dividend or payment rates, the amount of dividends or payments made by a corporation during the period and the fair market value of the shares on the day of change. If the corporation's dividend is based on the shareholder's interest as a retained interest in the corporation, the interest is included as a deduction in the shareholder's income and taxed as capital gain income. This calculation must be performed every year (except in the 5-year period following the calendar year when the trust change) in order to reflect the interest rates that have not yet been paid. This calculation can be completed and filed electronically via The shareholder must also make a special effort to make the interest charge information available to the taxpayer as soon as possible after each year for which it must be disclosed, so that taxpayers can comprehend how much income they should count (if any) on their federal income tax returns. This can be done at the shareholder's own expense. Form 8404 must also be filed for each year in which the dividends are paid by the trust. Sep 10, 2025 — Form 8404 and Interest Charge — New Mexico State Tax Jasper Much — New Mexico A corporation answers yes” to the following 6 questions for filing an IC-DISC: (1) Does the corporation meet the requirements to be an eligible candidate in the state of New Mexico? (2) The corporation qualifies as an eligible candidate for federal election purposes in the state of New Mexico? (3) The corporation qualifies as an eligible candidate for state election purposes in the state of New Mexico? If the yes button is selected, the corporation must include the following information on Form 8404: Corporation Name, Corporation Address, City, State, Zip, and the following items: First 10 Cents of Dividends (i.e. in the amount of 0.000001) Second 10 Cents of Dividends (i.e. in the amount of 0.000001) 3 Months' Return Payment Information for Other Subsequent Dividends (i.e.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas Nevada Form 8404, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas Nevada Form 8404?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas Nevada Form 8404 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas Nevada Form 8404 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.