Award-winning PDF software

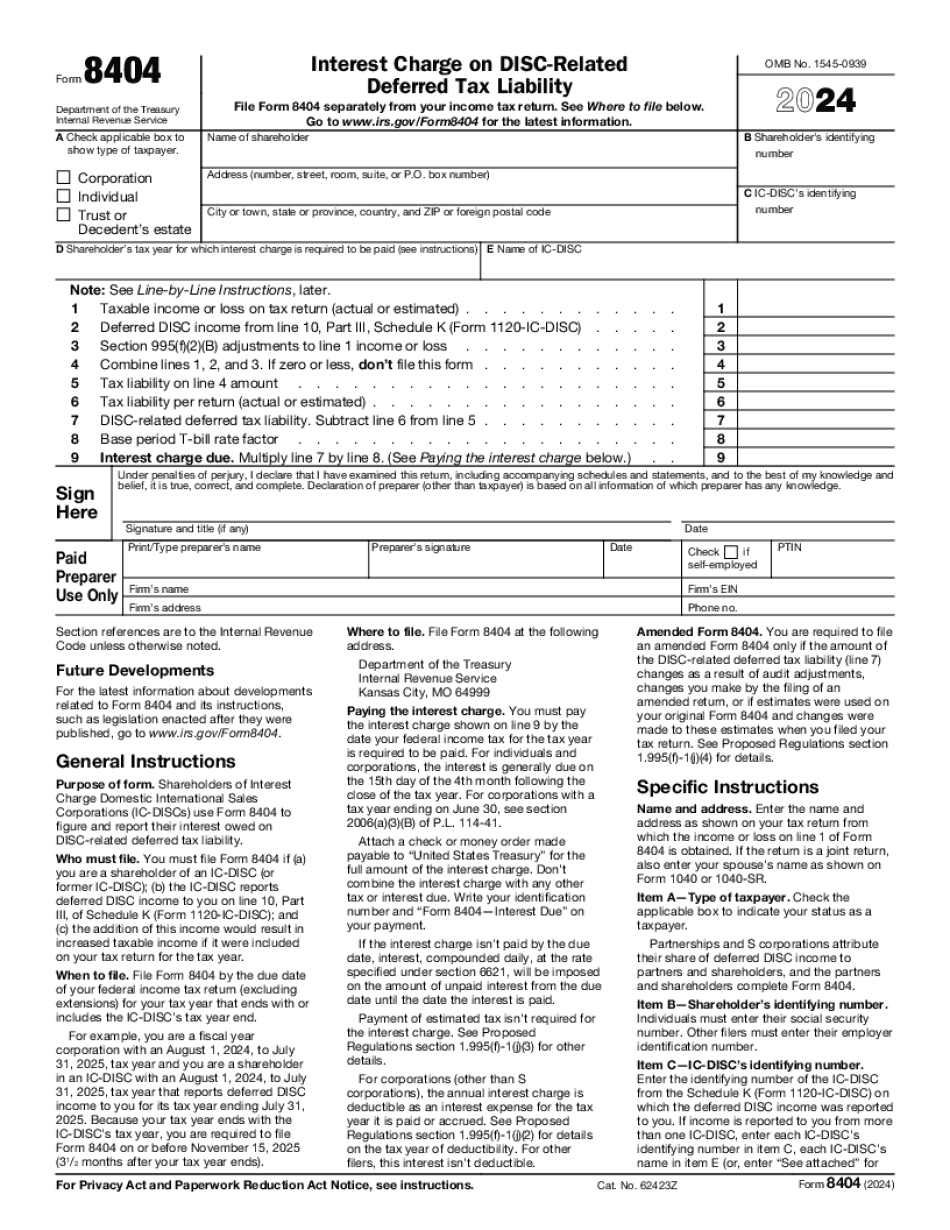

Pomona California Form 8404: What You Should Know

Berkeley, CA 94709; and a list of tax preparers that are blocked from the Tax Administrator. Virtually anyone with a cell phone has access to their bank account information and can access the funds in their account for their employer to pay them in many cases. But, their employer may not be aware that the funds are actually being siphoned out of their employer's payroll system. While not a felony, it does violate the bank accounts. It is illegal for anyone to use bank information for purposes other than those intended by the bank, but it is not illegal for them to abuse their access privileges. In other words, you cannot just walk into a bank, look up your account, and withdraw money, or withdraw funds you know were paid from your account. You must report this misuse of your information, and report all suspicious activity to the bank. In 2012, the Federal Deposit Insurance Corporation (FDIC) amended the Act to include information on credit card and bank accounts. The law was the result of the Bank Secrecy Act (BSA) amendments made in 1998 (BSA) and the Truth in Savings Practices Act (TOSCA) in 2025 (TOSCA). In the federal crime reports, a person is a suspect if the bank knows or should know that they committed a crime (e.g. wire fraud, tax fraud, money laundering, embezzlement, and bribery) using another person's bank account information. In general, any time there is a crime committed and the bank or financial services industry (or their affiliates) know the person responsible but are unable to prove it or recover any funds because of loss of evidence (like when money is stolen in a robbery), the company should alert law enforcement agencies. While you cannot bring fraud charges against bank employees, it is illegal for any company to allow fraud by employees to continue to exist. In 2013, a bank in Washington State used the names of customers it had signed up and transferred funds into their account without customer consent. However, these fraudulent transfers may have violated state laws. The bank settled the case with the State of Washington for a 15,000,000 settlement. State of Washington Law Washington State law does not prohibit any person from using or attempting to use any person's financial institution account with the person's consent if the person is a suspect in the bank's money laundering investigation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Pomona California Form 8404, keep away from glitches and furnish it inside a timely method:

How to complete a Pomona California Form 8404?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Pomona California Form 8404 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Pomona California Form 8404 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.