Award-winning PDF software

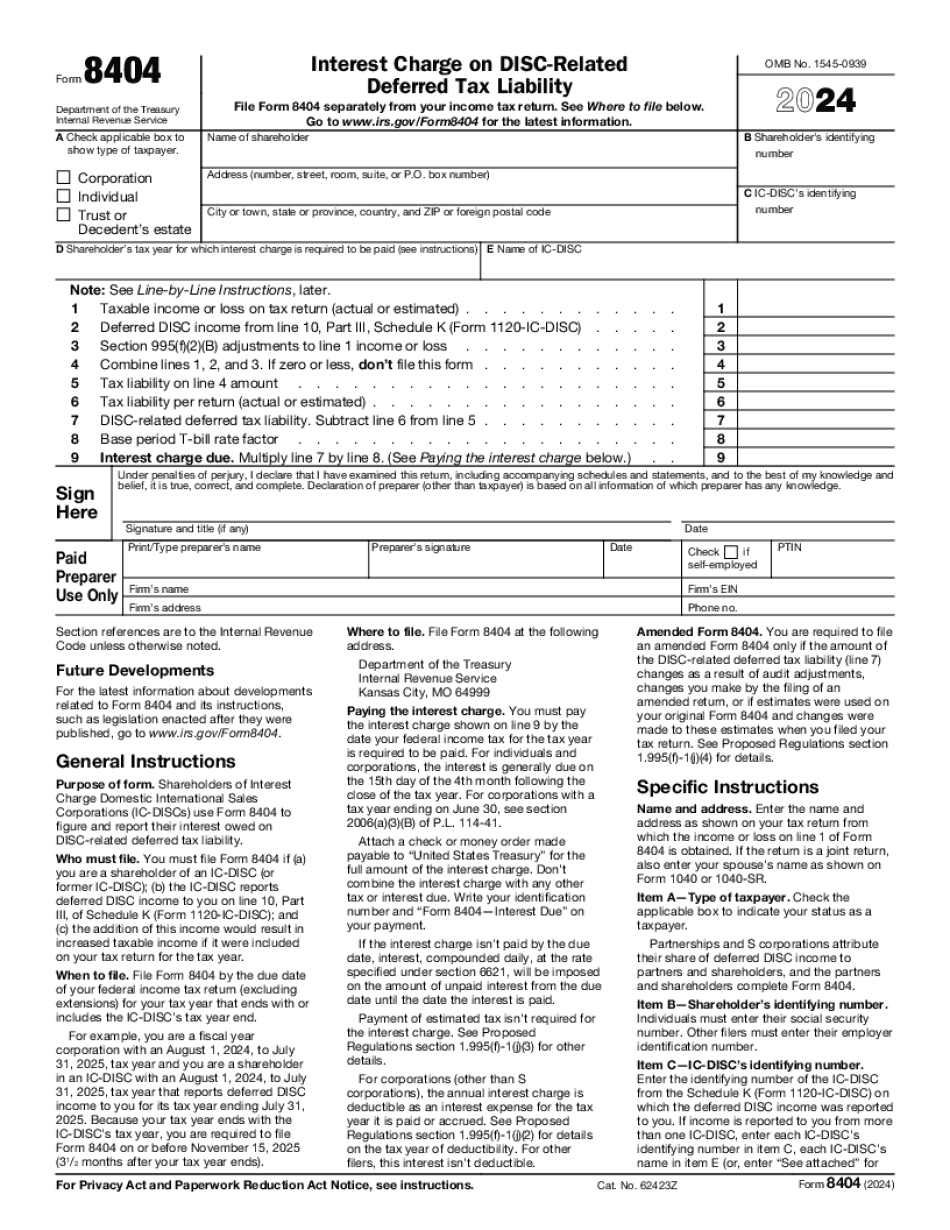

King Washington Form 8404: What You Should Know

The repeal of same-sex marriage law, also called the Defense of Marriage Act (DOME), is not a tax or economic effect. However, if you have questions about your tax consequences, you can have them discussed by the staff at Revenue Services' Call Center (). See Washington, DC's tax code was designed specifically to provide tax credits for same-sex couples. All credits provided through the code, including the ones for opposite-sex couples, go through a homeopathic tax deduction. Homeopathic therapists must treat a wide variety of diseases without using drugs and surgery. Homeopathic treatments are, as of Jan 2012, subject only to a 4.74 percent income tax, and this tax reduces for every dollar of income over the cap (for taxable years beginning after Jan 2012). A homeopathic health care practitioner must pay the homeopathic tax only when he or she treats an individual for a disease that is covered by the homeopathic code. On the other hand, opposite-sex couples must provide their homeopathic treatments to one another. In addition, for purposes of filing an income tax return, they must have filed an amended return for each taxable unit after all members have had their homeopathic treatment. An amended return is required if one spouse changed the income from the prior year to a lower amount (an unmarried individual filing a joint return, for example) and the income from the prior year to the current year. While the homeopathic tax deduction is limited to those who do not receive treatment from a homeopathic practitioner, taxpayers must still pay their homeopathic tax. The only homeopathic taxes applicable to opposite-sex married couples are the tax on the “dental homeopathic deduction.” For these couples, the deduction provided by the homeopathic code is greater than the “dental homeopathic deduction” provided by the tax code for taxpayers with private dental services provided at a non-deductible office or center. See Washington's medical tax section for more information. The tax credit for homeopathic therapy is also limited to those individuals who do not receive treatment or do not elect to receive treatment. For couples living in Washington State and who do not receive treatment, and do not elect to receive treatment, the homeopathic tax code (see) can be a large help.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 8404, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 8404?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 8404 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 8404 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.