Award-winning PDF software

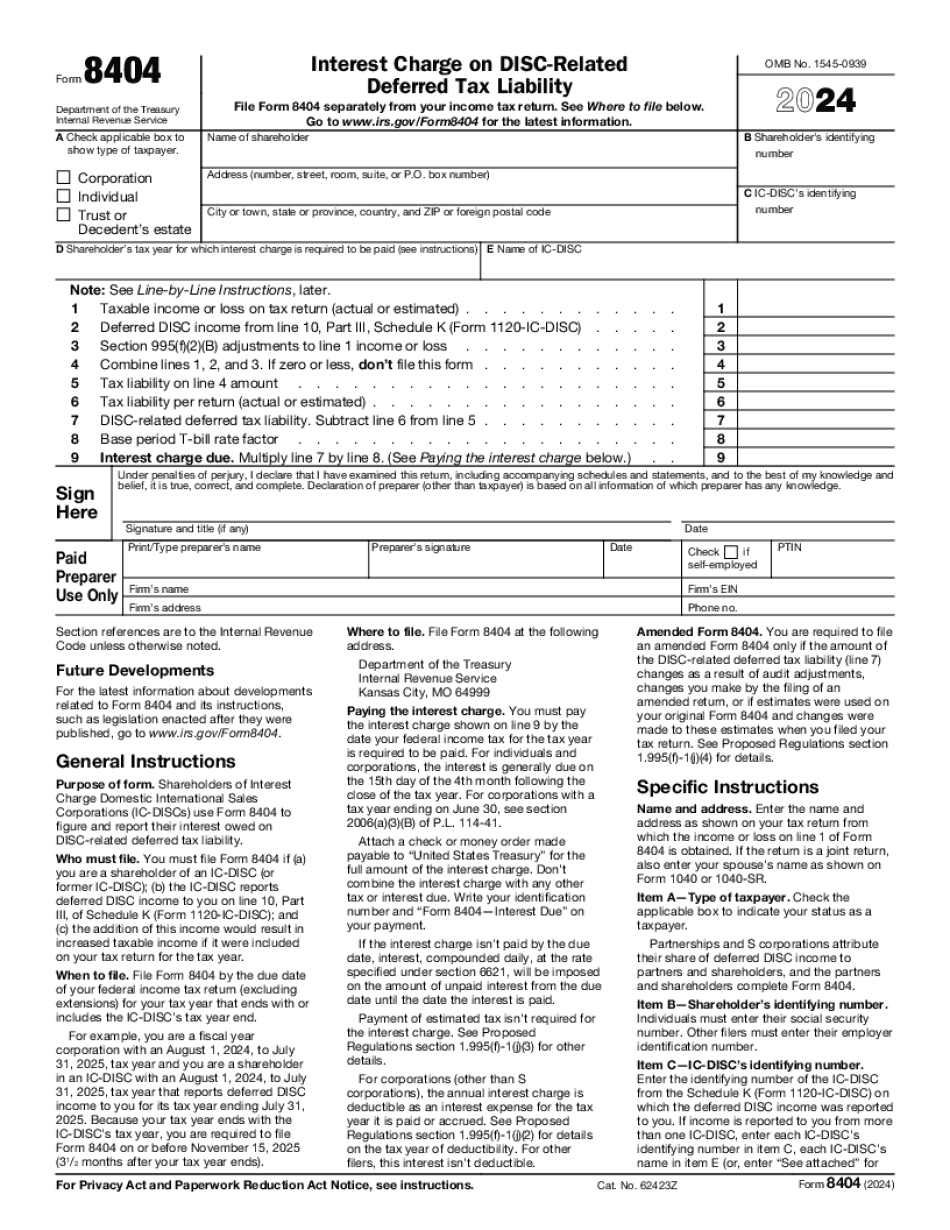

Form 8404 online Connecticut: What You Should Know

Whereas, marriage has long been recognized as the union of one man and one woman; and Whereas, in recent years the courts and legislatures of over a dozen States have invalidated state laws defining marriage as a union between man and woman; and Whereas, in light of increasing awareness of the benefits that marriage confers on children and society generally, and in recognition of the historic role of marriage in society, the American people believe that the federal government should recognize the marriage and marital status of same-sex couples, and in the same manner as opposite-sex couples; Now, therefore, be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That an Act to amend the Internal Revenue Code of 1954 (relating to the taxation of corporations) by adding section 3 (relating to marriage) and by repealing section 121a (relating to exclusion of spouse's earnings and losses for federal income tax purposes) be submitted to the Congress, and in addition to such title there may be added the following new title: “An Act to repeal the Defense of Marriage Act and ensure respect for State regulation of marriage.” TITLE I--MARRIAGE BY EXCLUSION OF SPOUSAL INCOME AND LOSSES Section 11012 of this title (relating to marriage by exclusion of spouse's income and losses) is amended by adding at the end the following new subsection: ``(g)(1)(A) For purposes of this subsection, in the case of a taxpayer who has a surviving spouse or surviving children, except as provided in subparagraph (B)— ``(i) the taxpayer's surviving spouse or surviving children with respect to whom a court issues a decree of divorce, or an order for support which includes a final determination that the individual is living separate and apart from the taxpayer, shall not be treated as a dependent of the taxpayer for purposes of any provision of this chapter, and ``(ii) the taxpayer's surviving spouse or surviving children with respect to whom a court issues a decree of domestic partnership, or an order for support which includes a final determination that the individual is living separate and apart from the taxpayer, shall, with respect to any year after the year in which such decree or order is entered, be treated as a dependent of the taxpayer for purposes of all provisions of this chapter except subparagraph (A)(i).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8404 online Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8404 online Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8404 online Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8404 online Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.